“The Great Grey City, brooking no rival, imposed its dominion upon a reach of country larger than many a kingdom of the Old World. For thousands of miles beyond its con fines was its influence felt…

It was Empire, the resistless subjugation of all this central world of the lakes and the prairies. Here, mid-most in the land, beat the Heart of the Nation, whence inevitably must come its immeasurable power, its infinite, infinite, inexhaustible vitality…

In its capacity boundless, in its courage indomitable; subduing the wilderness in a single generation, defying calamity, and through the flame and debris of a common wealth in ashes, rising suddenly renewed, formidable, and Titanic.”

Frank Norris, The Pit

Human ingenuity never fails to surprise me. Growing up in the Bay Area, I naturally conflated success – financial and otherwise – with building a software startup. But as I started university, my ideological bubble burst while simultaneously my views enlarged: opportunities, like diamonds, were lying in wait to be mined in every sector; my peers were creating companies in once-unheard of areas like insect farming or in those I couldn’t fathom like orchestrating security details for politicians. It was the first time I was exposed to the intricacies that lay behind plastic manufacturing or the perils of intra-African trade.

Nevertheless, I believe that delving into these complicated systems of logistics and construction might highlight a new perspective on re-industrialization. In the Sober Thought Experiment, I briefly addressed the importance of domestic supply chains and manufacturing; it was the supply chain revolution in the late 19th century that transformed everything from what we consume to how we consume it: In effect, first we make the tools and then the tools make us.

Chicago, the Grey City, was the centerpiece for this epochal upheaval, acting as the Midwestern breeding ground for the railroad industry, commodities futures, jazz, and religion; it touched everything under the sun. Everyone across the Midwest flocked to Chicago in search of opportunity because the antebellum period was an era of mystical change. These changing tides meant that in a span of three decades, what was once a prairie trading post morphed into a metropolis invoking both awe and fear. But in our times, with over 20 million Americans expected to be jobless and desperate for work, we’re reliving that same story once more.

“If [Chicago] was unfamiliar, immoral, and terrifying,” as the great historian William Cronon reflected, “it was also a new life challenging its residents with dreams of worldly success, a landscape in which the human triumph over nature had declared anything to be possible.”

Even though Chicago is a unique case, shaped by weeping conditions of industrialization and political upheaval, the city provides an archetype for dealing with vast change in tiny amounts of time. How do we get those unemployed back to work and prepare America for this century?

Writ large, we need to direct the aimless talent across the country into new industries as our ancestors did two centuries ago: Provided that the supply of money is expanding at unfathomable rates, we can use a chunk of this stimulus to build another industrial city that will act as America’s industrial base.

A Green New Deal

So, that begs the question: what can we learn from Chicago’s urban development and its rise as a global manufacturing hub?

Let’s look at the people, the industries, and the financing.

People: The word Chicago comes from the native American ‘Chigagou’ meaning ‘onion field,’ so the city’s later development makes this growth all the more extraordinary. The Dark city, as a trading hub, was a hub for polyglots, specifically Irish, German, and Polish émigrés along with Native Americans who were keen to sell their wares. But by 1830, Native Americans all but perished from the area and with nobody to stop them, the traders expanded their operations: by 1854, Chicago was the world’s largest grain port with more than 30,000 citizens. And only three decades later, the city built the world’s first skyscraper, the Home Insurance building, with a population size over 10x that at 300,000.

The diversity of chicago allowed it to scale into various sectors rapidly. Once it became the lodestar for Midwestern business, the agglomeration effects allowed it to attract even smarter and more ambitious people over time. In our times, the silver lining to an estimated 25% unemployment rate in the United States is that we have a diverse range of skill-sets, all itching to solve the nation’s problems. We merely need to funnel their talents into the areas with the highest productivity.

Industries: It’s tough to imagine, but Illinois was historically a fiscally-responsible state with consistent revenue coming from the wealth of its industries and public works. Two centuries ago, transportation was enormously in demand; Illinois, as a state, took advantage of this as a trading hub for the Midwest.

The Illinois & Michigan Canal in 1848 and the construction of the Illinois Central Railroad from 1851 to 1856 made the state a global trading destination. Indeed, it was the world’s greatest railroad center by 1856. From 1830 to 1900, the city – lawmakers and engineers – had created a canal and sewer system from the ground up, larger streets, and even reversed the flow of the Chicago River. This is what citizens can do when push comes to shove.

Financing: As described, Chicago had a strong manufacturing and industrial base, perhaps the strongest in the Midwest. Because entrepreneurs saw an opportunity in not just controlling the vertical integration, but the horizontal integration of their sectors, Chicago developed a commercial base alongside all the manufacturing technology. But trade inherently has risk, how did corporations avoid taking on too much volatility?

This led to the creation of one of the world’s largest options markets, the Chicago Mercantile Exchange, where traders could dampen their commodity risk by buying futures. It started off trading grains, soybeans, and live cattle; but in 2017, the exchange also trades Bitcoin futures. Futures contracts are important because they dampen risk.

To hedge against unexpected volatility, the contract sets a price in stone, which makes sure that the supplier is paid for their goods; otherwise, their product might be too expensive, or worse, too cheap. Lowering perceived risk incentivizes entrepreneurship and new businesses to flourish. However, we don’t lack cheap capital – the Federal Reserve has at least made that obvious. What we do require is a supply-side revolution – a Cambrian explosion of new business.

Something Wicked This Way Comes

“In a way it is even humiliating to watch coal-miners working. It raises in you a momentary doubt about your own status as an ‘intellectual’ and a superior person generally. For it is brought home to you, at least while you are watching, that it is only because miners sweat their guts out that superior persons can remain superior.”

George Orwell, Road to Wigan Pier

In the name of progress, industrial revolutions have enacted enormous growing pains on their populations: In England, workers were, literally, worked to the bone in many cases and in America, minority groups were used like coupons and disposed with similar carelessness in the effort to connect the frontiers. It’s therefore impossible to discuss the 20th century without hitherto addressing the plight of the downtrodden in centuries past due to such unparalleled growth.

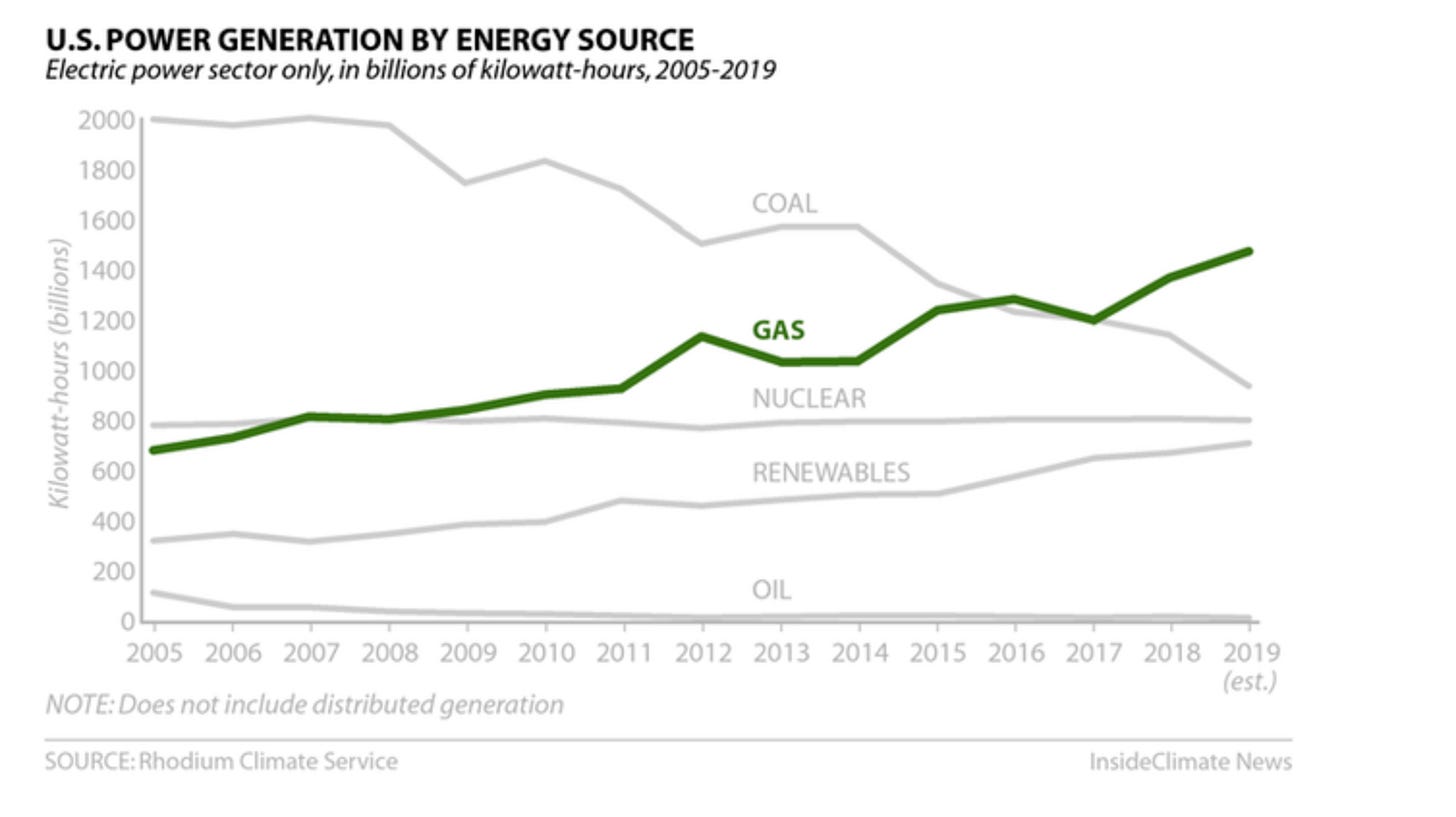

Contra naysayers, this doesn’t mean industrialization has been a net-negative for society. Take, for instance, the fact that there has been a long-term downward trend in emission levels in the United States largely due to the fact that coal belongs to a bygone era – the country is fed with natural gas, which is much cleaner than its predecessor – hence declining emissions. Rather than wag our fingers at developing countries who are industrializing, we should instead accelerate their process. In other words, the faster we can collectively learn from the past, the faster we can move beyond the collective ills of rapid technological growth.

So, how do we adapt the story of Chicago for this century?

Manufacturing From First Principles

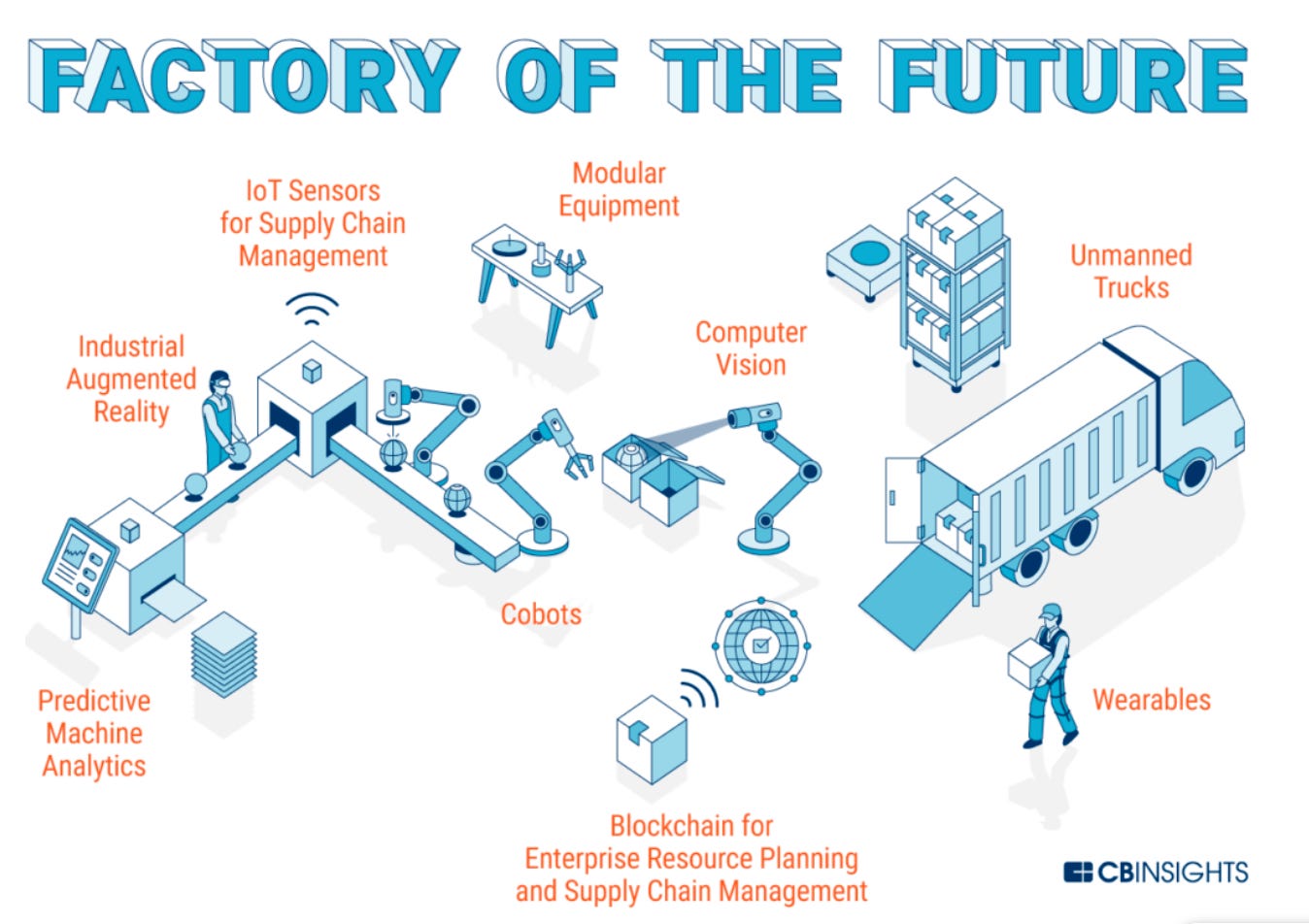

Given that FAANG is readily pursuing the healthcare and education sectors, government funding would be best spent on deeper-tech projects like robotics, boosting meta-efficiency, so that every layer of the stack can reap the rewards.

Additive manufacturing is already a must in any workshop, but when combined with robotic automation, it speeds up product testing with shorter feedback loops. Cobots, collaborative robots with programmable arms, are seen everywhere from Boeing to the Tesla factory as a way to automate the ad hoc jobs. Indeed, they’re meant to work alongside humans.

And the icing on the cake is that robots have been responsible for reshoring to the United States because of rising labor costs globally. Indeed, the labor debate in a remote-work world is centered around how cheaply countries can build software and robots – not about the quality of their human capital (though that does play a part). There is enormous amounts of work to be done, but all that’s missing is the political will to do so. Like Buffet remarked, “Never bet against America;” what can we achieve when cost isn’t an issue?

Chicago’s many lessons give us a framework for rapid development, industry, and finance. When we lament the stagnation, we should remember that we’re living in a golden age of communication technology; it requires Herculean levels of heat and pressure to conform carbon into diamonds and so it is that planning and executing the future is the hard part. Vision is not a commodity. If we’re going to print money regardless, we should spend it on building the country of the future – what else does a world after capital look like?

As always, if you enjoyed this post and want to reach out about either the piece or the podcast, I’d love to chat.

Speak soon,

Anirudh